Our Purpose, Mission and Values

Our Purpose

We want to inspire a stronger savings culture. We believe everyone should have the opportunity to save confidently.

Our Mission

- Providing cost-effective financing for government and the public good.

- Offering trusted savings and investments propositions.

- Delivering valued services for government.

- Supporting a fair and competitive market and balancing the interests of our savers, taxpayers and the market.

Our Values

With our customers:

Secure

100% security for savings, backed by HM Treasury. Our digital security is trustworthy. We protect our business.

Inspiring

Acting decisively and confidently for customers, working with pace to create value and inspiring them to secure their financial future.

Straightforward

Clear, every day, understandable language. Products designed simply to meet our customers’ needs, and easy-to-use services.

Reassuringly human

We listen to our customers and understand and respond to their needs. We care for our customers, our environment and the public good.

With our people:

We are responsible and do the right thing. We deliver safely and take a balanced approach to innovation and risk.

We use fresh thinking for the public good. We have a willingness to learn quickly. Diversity, innovation and curiosity are welcomed.

We have integrity and work together in straightforward ways. What we say matters. We are empowered by our leadership.

A small organisation with a big reach. We care for colleagues, respect one another, and invest in our people and manage their talent effectively.

About NS&I

Our Products and Services

NS&I raises cost-effective financing for the Government. We do this by offering savers the opportunity to invest in our range of savings products. When customers invest in NS&I products, they are lending to the Government. In return, the Government offers 100% security on all deposits and pays interest or prizes for Premium Bonds.

We were established 160 years ago and today our savings products are held by millions of customers across the UK. Our range includes Premium Bonds – one of the UK’s most popular and best-loved financial products with over £100 billion invested.

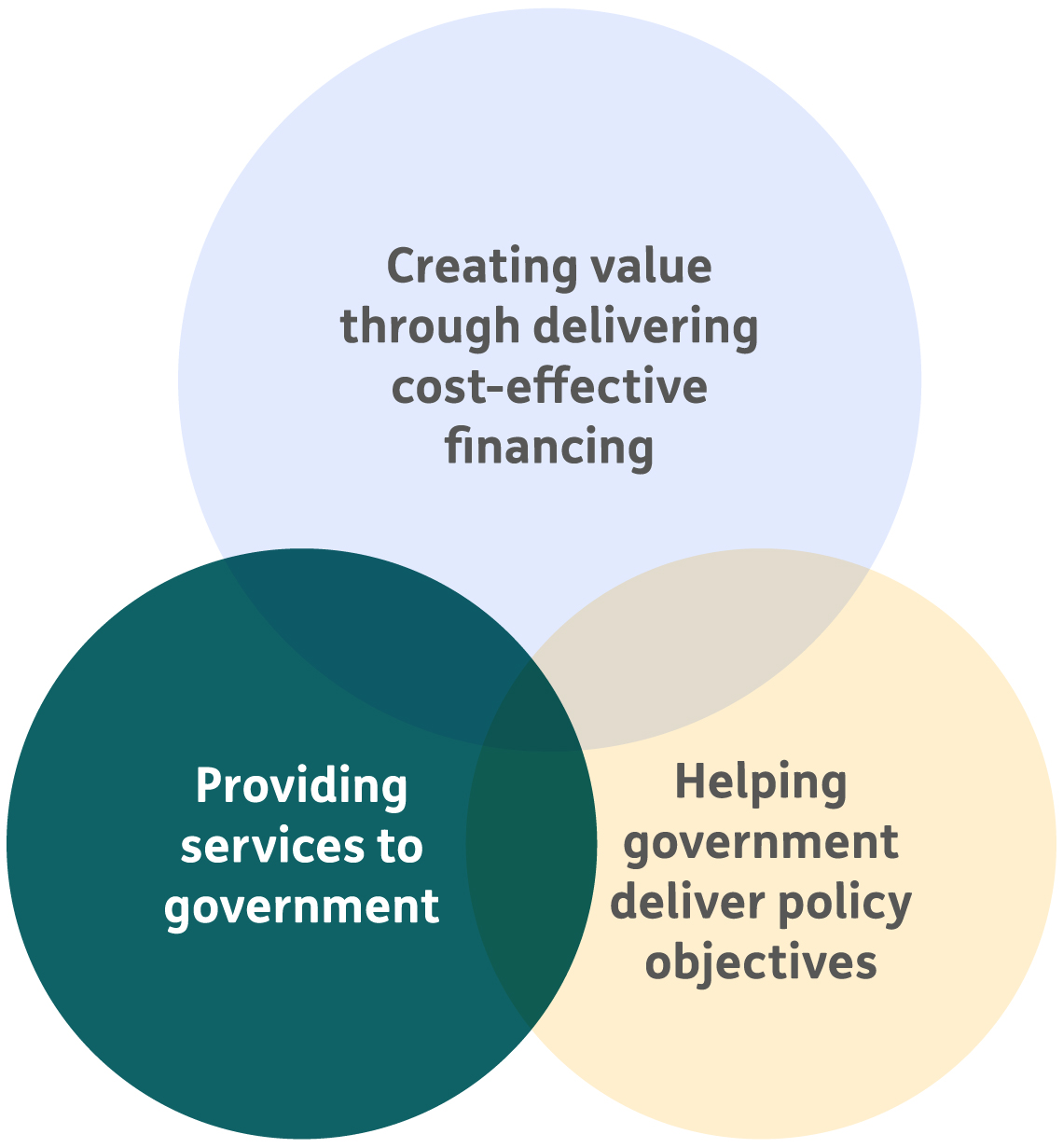

Alongside our core aim of delivering finance to HM Treasury to support public spending, we also have two other functions:

We leverage our expertise in banking and payment processing to provide these services to our partners across government. This provides other departments and public bodies with high quality, efficient services and provides NS&I with a funding source to support our core retail savings business. Our current government partners include the Ministry of Justice and HM Treasury’s popular Help to Save scheme.

We also use our knowledge of the savings sector to help government deliver its policy objectives. This includes delivering specific ‘policy products’ within the savings sector. In 2015 we launched 65+ Bonds which were the best-selling savings product launch in post-war history. We followed this in 2017 with Investment Guaranteed Growth Bonds.

In October 2021, we were proud to launch the world’s first sovereign green savings bond for retail investors. It gives UK savers the opportunity to support government spending projects that will accelerate the transition to a low carbon economy, create green jobs and participate in the collective effort to tackle climate change.

Our Operating Model and Outsourcing Partnership

NS&I is both a government department and an Executive Agency of the Chancellor of the Exchequer. We employ around 200 civil servants based largely in our London headquarters but also in our operational sites in Blackpool, Durham and Glasgow. Our people are drawn from across the private and public sectors with many coming from other financial services providers.

NS&I is extremely efficient: our operating budget is around £130 million per year. In fact, in 2020-21, for every £100 invested with us we spent less than 7 pence on administration.

At the heart of our efficient operating model is our outsourcing partnership. In May 2013, we announced that Atos had been awarded an outsourcing contract to deliver customer-facing and back-office services to our many millions of customers.

The current contract with Atos saved the taxpayer over £400 million up to 2021 and has delivered significant benefits to NS&I’s customers, including enhanced services on our website; the introduction of a lower £25 minimum investment for Premium Bonds, allowing family and friends to buy Premium Bonds for children; the launch of our NS&I’s Junior ISA; and the introduction of a smartphone app.

In April 2019, we exercised the option to extend the contract by an additional three years from 2021 to 2024. This contract will help NS&I to further enhance its customer service offer, with improved digital capability and a focus on ensuring that the business continues to provide security for customers’ savings and operates efficiently, using an infrastructure that provides value for money for taxpayers.

Atos deliver customer-facing services using a number of sites across the UK and also draw upon back-office services in Chennai, India.

Following a strategic review of our future business needs, HM Treasury has approved and funded a long-term transformation of our business. It is a statutory requirement for NS&I to re-tender its contract for outsourced services in advance of the contract with Atos expiring in March 2024.

Our ‘Rainbow Programme’ will see NS&I transition from a single public private partnership to a multi-supplier operating model from 2024. This change in approach is designed to:

- Measurably reduce the costs of running the business to ensure the sustainability of NS&I and to deliver long-term value for government.

- Deliver more nimbly, reducing risk and enhancing scalability; and

- Help NS&I become easier for customers to save with, as a self-service digital business with strong support for vulnerable and digitally excluded customers.

Our Strategy: Inspire & Invest

We are constantly evolving our offer to customers and to ensure our strategic business aims provide value for money for the taxpayer, as well as improving the experience of those who save with us.

Our strategy, Inspire & Invest, launched in 2018, maintains our strategic focus of raising cost-effective financing for the Government by offering savings and investment products to retail customers, but also prepares NS&I for the rapid pace of change being seen in the broader financial services sector.

“Inspire & Invest recognises the need for NS&I

to attract a new generation of customers both

to help inside a savings culture in the UK and

also to ensure the long-term sustainability of

our business.”

In addition, it formalised and built on two emergent areas of our previous strategy – providing payment processing services to other parts of government, which in turn helps fund NS&I’s core retail savings business; and the delivery of retail financial products and services to support specific government policy objectives. These activities help increase awareness of NS&I and attract new customers – and could reduce the cost of raising financing for government and leverage our considerable expertise.

Finally, Inspire & Invest recognises the need for NS&I to attract a new generation of customers both to help inspire a stronger savings culture in the UK and also to ensure the long-term sustainability of our business.

Inspire & invest has six cross-cutting strategic aims reflecting our joined-up approach to delivering our refreshed purpose and mission.

Delivering for Government

We raise public finances sustainably and efficiently, fully reflecting costs and risks. We build reliable and innovative services delivered at pace, which are valued by government. Delivering with us a compelling choice.

Delivering Digital-First Products and Services for our Customers

Our customers are at the heart of our business. We support savers in securing their financial future with straightfoward services, products, information, guidance and choices. We move quickly to adopt fintech-enabled services and solutions.

Using our Insight and Policy Expertise to Meet our Customers’ Needs

We learn quickly and are passionate about insight. We make decisions confidently grounded in knowing our customers and their savings needs. We put our data, insight, intelligence and fresh thinking to work for our customers and government partners, and to help effective policy. Our savings policy expertise, services and products are relevant and inspire a stronger savings culture.